Comprehensive Support for Your Financial Future

When you work with an advisor supported by LPL Financial, you gain access to the powerful tools, cutting-edge technology, and expert support designed to deliver personalized strategies that align with what matters most to you.

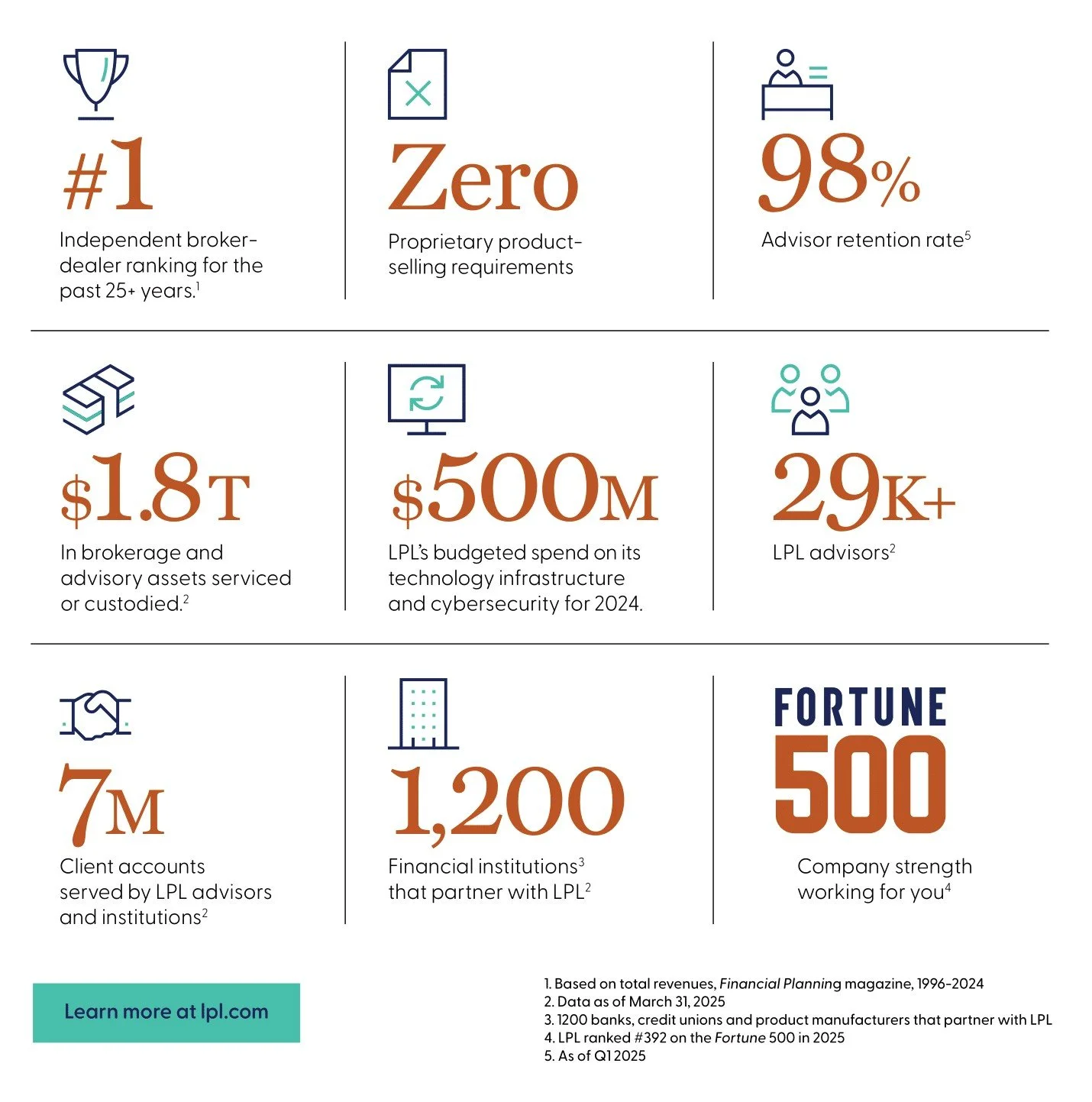

LPL at a Glance

A Foundation You Can Rely On

With no proprietary product agenda and a steadfast commitment to innovation and integrity, LPL Financial empowers your advisor to focus entirely on your unique needs. Whether you’re planning for retirement, managing complex wealth, or building a legacy, you’ll have the confidence of a powerful institution behind every step.

-

I advise individuals, families, business owners and Senior Professionals with at least $500,000 in retirement and non-retirement accounts combined in all aspects of Wealth Management including:

Retirement & Estate Planning.

Investment Portfolio Management.

Insurance Review.

-

That’s simple. My goal is to develop deep, long lasting relationships with my clients, getting to know them on a personal level. I take a vested interest in their financial success throughout the different stages of their lives.

-

Please feel free to either email or call me to ascertain how I may be of assistance.

-

Yes, as a registered broker-dealer, I usually receive a fee for the market value of the advisory assets I manage on behalf of my clients; however, I am able to offer brokerage services and am required to consider whether non-fee based services would be in the best interest of clients depending on their specific situation.